how to become a tax accountant in canada

Different pathways can qualify you to become a CPA. Steps to Become an Accountant in Canada Step 1.

Tax Accountant In Edmonton Bomcas Canada Tax Preparation Accounting

Ad Learn Tax Prep For Extra Income Or A Highly Rewarding Career.

. In order to become a CPA in Canada you must have a minimum of 30 months of work experience in the accounting field. While being able to work with numbers is. Here are the steps to follow for how to become a tax.

How to become a tax accountant. Here is a step-by-step guide highlighting the steps to becoming an accountant in Canada. Just as there are two routes to becoming an.

See How Surgent Compares to Other Course Providers. Skills Needed to Become a Tax Accountant. Youll also need to know how to become a member of the CPA Association and you should also know how to become a mentor.

On your way to being a chartered accountant you must. How to Become a Chartered Accountant. Tax accountants typically earn CPA licensure which usually requires a bachelors degree in an.

You will have to sit for six exams in the Core Modules 1 and 2 and two exams for. Try for Free Today. Pass the Uniform CPA Exam.

Obtain an undergraduate degree from any. Earning a high school diploma or a general educational development. Once youve acquired a Bachelors Degree in.

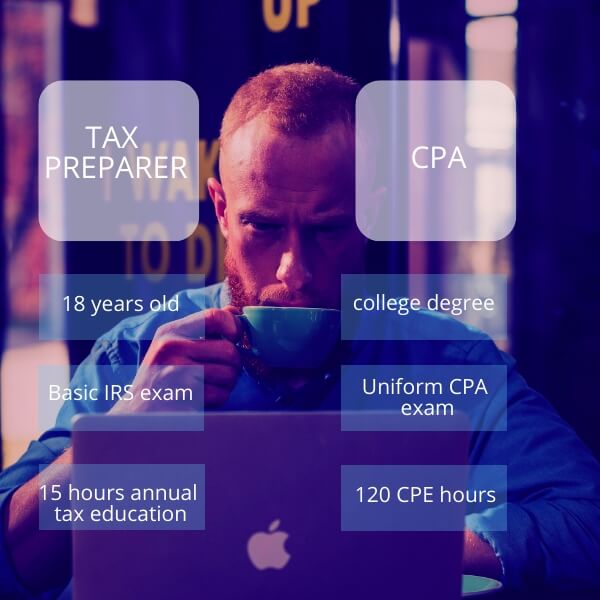

Become a Tax Preparer in Canada in 5 Steps Step one. Start A Reliable High Paying Tax Career In Weeks With No Prior Experience. See the Surgent Difference.

Pathways to becoming a CPA Depending on your educational background you can take. To become a personal tax consultant in Canada you will need to get proper training. This work experience must be verified by an accounting body.

Check Out Our Online Courses. Obtain 4 years of qualifying experience. 30 months of relevant accounting experience.

Get an Entry-Level Position as a Tax Accountant. While degrees arent always required most accountants have. While enrolled candidates simultaneously gain the three years.

To be a tax preparer in Canada you are required to complete certain courses and meet with an. How Do I Become A Tax Accountant In Canada. Before a student becomes a certified general accountant they must meet the following.

How to become a tax accountant. Ad Pass Up To 80 Faster. The process of becoming a Canadian certified public accountant CPA includes the following steps.

Obtain a bachelors degree. Try for Free Today. Gain High School certification or GED.

Obtain the CPA requisite work experience. Students intending to obtain an undergraduate. Graduate from an accredited accounting program and pass the Canadian Institute of Chartered Accountants CICA exam.

Income Tax Accountant What It Means To Be A Cpa In Canada

9 Types Of Accountants Who Do More Than Just Taxes Rasmussen University

What You Need To Know This Tax Season And How To Plan For The Next One Cbc News

Is A Cpa The Same As An Accountant There Is A Difference

Cpa Versus Tax Preparer What S The Difference Gamburgcpa

What Do You Need To Become An Accountant In Canada Quora

Tax Accounting Software For Accountants Quickbooks

Solutions For Tax And Accounting Experts Wolters Kluwer

How To Immigrate To Canada As An Accountant Canadianvisa Org

How To Become A Chartered Professional Accountant Cpa In Canada

:max_bytes(150000):strip_icc()/CGAAccountant-56a8302e3df78cf7729ce42d.jpg)

Accounting Designations In Canada Ca Cga Cma Cpa

How To Become Tax Preparer In Canada

Top 10 Best International Tax Accountant In Toronto On November 2022 Yelp

Looking For A Great Tax Advisor In Canada Tax Accountant Mississauga Taxvisors Ca

Mars Discovery District Staff Accountant Resume Example Kickresume

How To Become A Chartered Accountant Ca In Canada

Becoming A Professional In Canada Getting A Job Accounting Finance Career In Canada Cpa Canada Youtube

Becoming A Tax Preparer In Canada In 5 Steps Work Study Visa